Table of Contents

Sand remains one of the most essential construction materials in India, with prices in 2026 ranging from ₹800 to ₹3,500 per ton depending on type, quality, and location. Understanding current sand rates is crucial for accurate project budgeting, as sand costs typically account for 12-18% of total construction expenses in residential and commercial projects. This comprehensive guide covers the latest 2026 sand prices, different types available, regional variations, and emerging market trends that are reshaping India’s construction industry.

Current Sand Price Per Ton (2026)

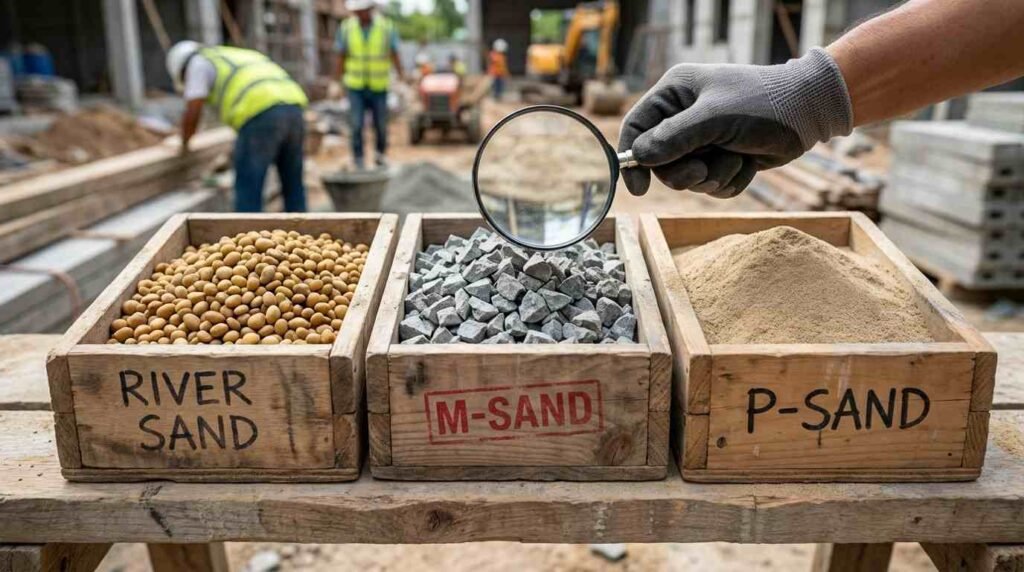

Sand prices in India have stabilized in 2026 after significant fluctuations in previous years, with manufactured sand (M-sand) becoming increasingly dominant due to environmental regulations restricting river sand mining. The national average for river sand now stands at ₹2,200 to ₹3,200 per ton, while M-sand offers a more economical option at ₹1,400 to ₹2,200 per ton. These prices reflect ex-factory or stockyard rates and can increase by 15-30% when transportation and handling charges are included. The government’s push toward sustainable construction practices has made M-sand the preferred choice for large-scale infrastructure and residential projects across most Indian states.

| Sand Type | Price Range (Per Ton) | Typical Use | Availability |

|---|---|---|---|

| River Sand | ₹2,200 – ₹3,200 | Plastering, masonry work | Limited due to mining restrictions |

| M-Sand (Manufactured Sand) | ₹1,400 – ₹2,200 | RCC work, structural concrete | Widely available nationwide |

| P-Sand (Plastering Sand) | ₹1,600 – ₹2,000 | Interior/exterior plastering | Good availability |

| Pit Sand (Coarse Sand) | ₹1,800 – ₹2,600 | Foundation work, load-bearing structures | Regional availability |

| Concrete Sand | ₹1,500 – ₹2,100 | Concrete mixing, flooring | Widely available |

| Fill Sand | ₹800 – ₹1,200 | Land filling, backfilling | Readily available |

River Sand vs M-Sand Price Comparison

River sand continues to command premium prices in 2026 due to stringent environmental regulations and limited mining permits, with costs reaching ₹2,500 to ₹3,500 per ton in metro cities. The National Green Tribunal’s restrictions on riverbed mining have created supply constraints, pushing builders toward manufactured alternatives. M-sand, produced by crushing hard granite or basalt stones, offers 15-30% cost savings compared to river sand while maintaining comparable strength characteristics for structural applications. Modern crushing technologies in 2026 have improved M-sand quality significantly, with controlled particle size distribution and reduced silt content making it suitable for high-grade concrete work.

The key difference lies in surface texture and workability – river sand has naturally rounded particles that provide better workability for plastering, while M-sand’s angular particles offer superior bonding strength for concrete work. Many contractors now adopt a hybrid approach, using M-sand for structural elements (columns, beams, slabs) and reserving river sand for finishing work where workability is critical. This strategy optimizes both cost efficiency and construction quality, particularly important for projects with tight budget constraints.

| Comparison Factor | River Sand | M-Sand (Manufactured Sand) |

|---|---|---|

| Price per ton (2026) | ₹2,200 – ₹3,200 | ₹1,400 – ₹2,200 |

| Cost difference | Baseline (higher) | 15-30% cheaper |

| Particle shape | Naturally rounded | Angular, crushed |

| Silt content | 3-8% (variable) | <3% (controlled) |

| Strength for concrete | Good | Excellent |

| Workability for plaster | Excellent | Good to Fair |

| Availability | Limited, regulated | Widely available |

| Environmental impact | High (riverbed damage) | Lower (quarry-based) |

| Quality consistency | Variable | Consistent |

| Best application | Plastering, masonry | RCC, structural concrete |

🏗️ Sand Cost & Quantity Calculator

Calculate the exact amount of sand needed for your construction project and get accurate cost estimates based on current 2026 rates

📐 Project Details

💰 Sand Type & Regional Pricing

📋 Your Sand Calculation Results

💵 Cost Breakdown

Regional Sand Price Variations Across India

Metro cities like Mumbai, Delhi, Bangalore, and Hyderabad experience the highest sand prices in 2026, with river sand costing ₹2,500 to ₹3,500 per ton due to strict mining regulations, long transportation distances, and continuous construction demand. Chennai shows relatively balanced pricing with M-sand available around ₹1,250 per ton ex-factory, while Hyderabad river sand ranges from ₹1,400 to ₹2,500 per ton depending on source and quality. The Telangana government has implemented controlled pricing at official stockyards, fixing coarse sand at ₹1,600 per metric ton and fine sand at ₹1,800 per ton to prevent market exploitation. These government-regulated rates help stabilize prices and ensure fair access for small builders and individual homeowners.

Tier-2 cities like Patna, Jaipur, Indore, and Vijayawada generally see moderate pricing with river sand at ₹2,000 to ₹2,800 per ton and M-sand at ₹1,000 to ₹1,500 per ton. Tier-3 and semi-urban areas offer the most competitive rates, with river sand priced at ₹1,800 to ₹2,500 per ton and M-sand at ₹800 to ₹1,200 per ton, though quality consistency can vary. Coastal regions face unique challenges with sea sand being locally abundant but unsuitable for construction due to high salt content, necessitating inland transportation of proper construction-grade sand.

| Region Type | River Sand (per ton) | M-Sand (per ton) | Key Factors |

|---|---|---|---|

| Metro Cities (Mumbai, Delhi, Bangalore) | ₹2,500 – ₹3,500 | ₹1,200 – ₹1,800 | Strict regulations, high transport costs |

| Tier-1 Cities (Pune, Ahmedabad, Chennai) | ₹2,200 – ₹3,000 | ₹1,100 – ₹1,600 | Moderate regulations, good availability |

| Tier-2 Cities (Jaipur, Indore, Vijayawada) | ₹2,000 – ₹2,800 | ₹1,000 – ₹1,500 | Balanced demand-supply |

| Tier-3/Semi-Urban Areas | ₹1,800 – ₹2,500 | ₹800 – ₹1,200 | Lower transport costs, variable quality |

| Coastal Areas (with transport) | ₹2,300 – ₹3,200 | ₹1,100 – ₹1,700 | Sea sand unsuitable, inland sourcing needed |

| Northern States (NCR, Punjab) | ₹2,400 – ₹3,000 | ₹1,300 – ₹1,800 | Seasonal river variations |

| Southern States (Tamil Nadu, Karnataka) | ₹2,000 – ₹2,800 | ₹1,000 – ₹1,500 | Better M-sand infrastructure |

Types of Construction Sand and Their Applications

Understanding different sand types helps optimize material selection for specific construction requirements and budget constraints. River sand, extracted from riverbeds, features naturally smooth rounded particles making it ideal for plastering work where smooth finish and excellent workability are essential. Its superior bonding properties with cement make it the preferred choice for exterior and interior plaster coats, though availability restrictions in 2026 have pushed many builders toward alternatives. M-sand has emerged as the most versatile option, with controlled manufacturing ensuring consistent gradation, minimal silt content below 3%, and angular particles that provide excellent mechanical bonding in concrete.

P-sand (plastering sand) is a specially processed variant of M-sand with finer particles designed specifically for plastering applications, offering a middle ground between river sand’s workability and M-sand’s availability. Pit sand, also called coarse sand, is excavated from soil pits and contains sharp angular grains ideal for foundation work and load-bearing structures where high strength is paramount. Concrete sand has a specific gradation optimized for concrete mixing, ensuring proper cement binding and adequate void filling for durable concrete structures. Fill sand, the most economical option, serves non-structural purposes like land filling, backfilling around foundations, and leveling work where material strength is not critical.

| Sand Type | Particle Size | Price Range (per ton) | Primary Applications | Key Characteristics |

|---|---|---|---|---|

| River Sand | 0.5 – 2.0 mm | ₹2,200 – ₹3,200 | Plastering, mortar, masonry | Smooth, rounded, excellent workability |

| M-Sand | 0.15 – 4.75 mm | ₹1,400 – ₹2,200 | RCC, beams, columns, slabs | Angular, consistent quality, high strength |

| P-Sand | 0.15 – 2.0 mm | ₹1,600 – ₹2,000 | Plastering (interior & exterior) | Fine grade, good finish, better than M-sand for plaster |

| Pit Sand | 2.0 – 4.75 mm | ₹1,800 – ₹2,600 | Foundations, heavy masonry | Coarse, sharp edges, very high strength |

| Concrete Sand | 0.5 – 4.0 mm | ₹1,500 – ₹2,100 | Concrete mixing, flooring | Balanced gradation, optimal for concrete |

| Fill Sand | Variable | ₹800 – ₹1,200 | Backfilling, leveling, land filling | Economical, non-structural use |

| Silica Sand | 0.1 – 0.6 mm | ₹3,000 – ₹5,000 | Glass, foundries, industrial use | High purity, specialized applications |

Sand Quantity Requirements and Costs Per Square Foot

A typical residential RCC house construction requires approximately 1.8 to 2.6 cubic feet (CFT) of sand per square foot of built-up area, covering all requirements including foundation work, structural concrete, masonry, and plastering. This translates to roughly 50-75 kg of sand per square foot depending on construction method, number of floors, and finishing quality. For a standard 1,000 sq ft apartment, total sand requirement ranges from 1,800 to 2,600 CFT, which equals approximately 30-45 tons considering sand density of about 1,600 kg per cubic meter. The sand cost per square foot varies from ₹35-50 for basic budget construction to ₹70-90 for premium high-quality construction, not including labor charges.

Breaking down sand usage by construction stage: foundation work consumes about 20-25% of total sand (mostly coarse sand or M-sand), structural RCC elements like columns, beams, and slabs account for 35-40% (primarily M-sand or concrete sand), masonry work uses 20-25% (M-sand or river sand), and plastering takes the remaining 15-20% (preferably P-sand or river sand). Different construction methods impact sand consumption significantly – load-bearing structures typically require 10-15% more sand compared to RCC framed structures due to thicker walls and increased masonry work.

| Construction Type | Sand per Sq Ft (CFT) | Sand Cost per Sq Ft | Total for 1000 Sq Ft |

|---|---|---|---|

| Basic/Budget Construction | 1.8 – 2.0 CFT | ₹35 – ₹50 | ₹35,000 – ₹50,000 |

| Standard RCC Residential | 2.0 – 2.4 CFT | ₹50 – ₹70 | ₹50,000 – ₹70,000 |

| Premium Quality Construction | 2.4 – 2.6 CFT | ₹70 – ₹90 | ₹70,000 – ₹90,000 |

| Ground Floor Only | 1.8 – 2.1 CFT | ₹40 – ₹55 | ₹40,000 – ₹55,000 |

| Ground + First Floor | 2.1 – 2.4 CFT | ₹55 – ₹75 | ₹55,000 – ₹75,000 |

| Multi-story (3+ floors) | 2.3 – 2.6 CFT | ₹65 – ₹85 | ₹65,000 – ₹85,000 |

Sand Price Per CFT and Unit Conversion

Understanding price per cubic foot (CFT) helps contractors and homeowners compare rates more effectively when purchasing smaller quantities from local dealers. In 2026, river sand typically costs ₹100-110 per CFT, while M-sand ranges from ₹60-70 per CFT, explaining why M-sand increasingly dominates cost-conscious construction projects. One ton of sand equals approximately 22-24 CFT depending on moisture content and compaction, with dry sand being lighter and occupying more volume than damp sand. Local dealers often sell by brass (100 CFT) or truck loads rather than by ton, making unit conversion knowledge essential for price comparison.

Converting between units: 1 ton = 22-24 CFT = 0.625 cubic meters (for typical sand density of 1,600 kg/m³), and 1 brass = 100 CFT = approximately 4.2 tons. A standard truck can carry 8-12 tons of sand (approximately 180-275 CFT), with capacity varying based on truck size and local regulations. Bulk purchases exceeding 50 tons often qualify for 10-15% discounts compared to retail rates, making pre-negotiated contracts beneficial for large projects. Some suppliers in 2026 offer online ordering platforms with transparent per-ton pricing and delivery tracking, improving price transparency in the traditionally opaque sand market.

| Unit | Equivalent in Other Units | River Sand Price | M-Sand Price |

|---|---|---|---|

| 1 Ton | 22-24 CFT | ₹2,200 – ₹3,200 | ₹1,400 – ₹2,200 |

| 1 CFT | 0.042 – 0.045 tons | ₹100 – ₹110 | ₹60 – ₹70 |

| 1 Brass | 100 CFT = 4.2 tons | ₹8,500 – ₹9,000 | ₹6,500 – ₹7,000 |

| 1 Cubic Meter | 1.6 tons = 35-38 CFT | ₹3,500 – ₹5,100 | ₹2,200 – ₹3,500 |

| 1 Truck Load (8 tons) | 180-190 CFT | ₹17,600 – ₹25,600 | ₹11,200 – ₹17,600 |

| 1 Truck Load (12 tons) | 265-290 CFT | ₹26,400 – ₹38,400 | ₹16,800 – ₹26,400 |

| Retail (1-10 tons) | Per ton | ₹2,500 – ₹3,500 | ₹1,800 – ₹2,200 |

| Bulk (50+ tons) | Per ton (with discount) | ₹2,200 – ₹3,000 | ₹1,400 – ₹1,800 |

Factors Affecting Sand Prices in 2026

Transportation costs represent 20-35% of final sand prices, with rates increasing proportionally to distance from mining or manufacturing locations. Projects located more than 100 km from sand sources face significantly higher costs, adding ₹300-600 per ton in freight charges depending on fuel prices and road conditions. Environmental regulations have become the primary price driver in 2026, with strict mining permissions and quarterly inspections limiting river sand availability and pushing prices upward. The National Green Tribunal’s enforcement of sustainable mining practices has reduced legal river sand supply by approximately 40% compared to five years ago, creating supply-demand imbalances in many states.

Seasonal variations impact pricing particularly during monsoon months (June-September) when riverbed mining becomes impossible and transportation challenges increase costs by 15-25%. Quality specifications also influence pricing – washed sand with minimal silt content commands 10-15% premium over unwashed varieties, while specific gradation requirements for high-grade concrete can add ₹200-400 per ton. Government policies like the Telangana Sand Bazaar initiative have introduced price stabilization in some states through controlled stockyards, though most regions still operate on open-market pricing. Global sand market dynamics, with the construction sand market projected to reach $159.55 billion in 2024-25 growing at 4% CAGR, indicate continued upward price pressure worldwide.

| Price Factor | Impact on Cost | Price Variation | Mitigation Strategy |

|---|---|---|---|

| Transportation Distance | High | ₹300 – ₹600 per ton per 100 km | Source locally, bulk purchase with delivery |

| Environmental Regulations | Very High | 30-50% price increase for river sand | Switch to M-sand for eligible applications |

| Seasonal Variations (Monsoon) | Medium | 15-25% increase June-Sept | Pre-purchase and stockpile before monsoon |

| Quality & Washing | Medium | 10-15% premium for washed sand | Assess project needs, use unwashed for non-critical work |

| Silt Content | Low-Medium | ₹100 – ₹300 per ton | Specify max silt requirements in contract |

| Bulk vs Retail Purchase | Medium | 10-15% discount for 50+ tons | Coordinate with neighboring projects for bulk order |

| Government Control | Variable | Fixed rates in some states | Purchase from official stockyards where available |

| Market Demand (Local) | Medium | 10-20% fluctuation | Monitor local rates, negotiate during low-demand periods |

M-Sand Production and Market Trends

Manufacturing technology for M-sand has advanced significantly in 2026, with modern vertical shaft impactors (VSI) producing consistently graded sand with optimal particle shapes for construction applications. The process involves crushing hard rocks like granite or basalt into specified sizes, followed by screening and washing to achieve the desired gradation and cleanliness. Quality M-sand plants now incorporate multiple crushing stages, fine aggregate washing systems, and automated quality control to ensure consistency batch-to-batch. This technological evolution has improved M-sand acceptance among contractors, with many premium projects now specifying M-sand over river sand for structural concrete work.

The manufactured sand market in India is growing at approximately 12-15% annually, driven by environmental awareness, government mandates, and proven performance in infrastructure projects. Major infrastructure initiatives like highways, metro rail projects, and smart city developments increasingly specify M-sand in technical specifications, normalizing its use across the industry. The rising adoption of manufactured sand presents significant opportunities for market expansion, with the global trend toward sustainable alternatives supporting M-sand’s continued growth. Quality certification programs introduced by state governments ensure M-sand meets IS 383:2016 standards for fine aggregates, building confidence among engineers and architects.

| Aspect | Details (2026) |

|---|---|

| Production Method | VSI crushing, multi-stage screening, washing |

| Raw Material Source | Granite, basalt, hard rock quarries |

| Quality Standard | IS 383:2016 for fine aggregates |

| Market Growth Rate | 12-15% annually in India |

| Particle Size Range | 0.15 mm – 4.75 mm (controlled) |

| Silt Content | <3% (typically 1-2%) |

| Manufacturing Capacity | 100-500 TPH per plant (typical) |

| Major Producers | Local crushers, organized players entering market |

| Government Support | Mandatory use in government projects in many states |

| Certification Requirements | IS certification, environmental clearance, quality testing |

| Technology Adoption | Automated grading, AI-based quality control |

| Environmental Impact | 60-70% lower than river sand mining |

Sand Quality Parameters and Testing

Quality assessment for construction sand focuses on particle size distribution, silt content, moisture content, and specific gravity to ensure structural integrity and workability. Sieve analysis determines gradation, with ideal sand passing through 4.75mm IS sieve while retained percentages on finer sieves indicate proper distribution. Silt content should not exceed 8% for natural sand and 3% for manufactured sand, as excessive silt weakens concrete bonding and increases water demand. Field testing includes the simple hand test where clean sand squeezed in a fist should not form a cohesive lump, indicating low silt and clay content.

Laboratory tests for sand quality include specific gravity testing (typical range 2.60-2.70), bulk density determination (1,400-1,900 kg/m³), and organic impurities testing to ensure no harmful organic matter that could affect cement setting. Modern projects in 2026 increasingly require certified test reports from NABL-accredited laboratories, particularly for high-rise buildings and infrastructure projects where material failure could have catastrophic consequences. Visual inspection remains important – good quality sand should be free from shells, vegetation, stones larger than specified size, and should not contain significant dust or clay coatings on particles.

| Quality Parameter | River Sand Standards | M-Sand Standards | Test Method |

|---|---|---|---|

| Silt Content | <8% (preferably <5%) | <3% (preferably <2%) | Field settling test, lab wash test |

| Moisture Content | 2-5% | 2-4% | Oven dry method |

| Specific Gravity | 2.60 – 2.70 | 2.60 – 2.75 | Pycnometer test |

| Bulk Density | 1,450 – 1,650 kg/m³ | 1,600 – 1,900 kg/m³ | Unit weight test |

| Particle Size (4.75mm sieve) | 90-100% passing | 95-100% passing | Sieve analysis |

| Fineness Modulus | 2.2 – 3.2 | 2.6 – 3.0 | Calculated from sieve analysis |

| Organic Impurities | Lighter than standard | Not applicable | Colorimetric test |

| Water Absorption | 0.5 – 2% | 1 – 3% | Absorption test |

| Soundness | <10% loss | <12% loss | Sodium sulfate test |

| Deleterious Materials | <3% by mass | <2% by mass | Visual inspection, washing |

Bulk Purchasing and Supplier Selection

Establishing relationships with reliable sand suppliers can reduce costs by 12-20% through negotiated rates, consistent supply, and reduced procurement time. Bulk purchase agreements for 50+ tons typically include delivery scheduling, quality guarantees, and price locks for 3-6 months, protecting projects from market volatility. Online platforms have emerged in 2026 offering transparent pricing, quality certifications, and direct-from-manufacturer purchases that eliminate middleman margins. Evaluating suppliers should consider price competitiveness, quality consistency (request sample testing), delivery reliability, and documentation completeness including transportation permits and quality certificates.

Direct sourcing from M-sand manufacturing plants rather than dealers can save ₹200-400 per ton, particularly worthwhile for projects requiring more than 100 tons. Payment terms significantly impact effective cost – immediate cash payment often earns 2-3% discount, while 30-day credit may cost 3-5% premium. For large projects, establishing on-site sand storage minimizes delivery frequency costs and ensures continuous material availability, though adequate drainage and covering are essential to prevent quality degradation. Supplier reputation matters critically as sand shortages mid-project cause costly delays, making slightly higher prices from reliable suppliers often worthwhile for project timeline certainty.

| Purchase Volume | Typical Price (M-Sand) | Delivery Terms | Best For |

|---|---|---|---|

| 1-5 tons (Retail) | ₹1,800 – ₹2,200/ton | Multiple small loads | Small repairs, minor work |

| 6-20 tons | ₹1,600 – ₹2,000/ton | 1-2 truck loads | Individual house construction |

| 21-49 tons | ₹1,500 – ₹1,800/ton | Multiple deliveries | Multi-floor buildings |

| 50-100 tons (Bulk) | ₹1,400 – ₹1,700/ton | Scheduled deliveries | Housing projects, commercial buildings |

| 100+ tons (Project) | ₹1,300 – ₹1,600/ton | Contract-based supply | Large infrastructure, multiple buildings |

| 500+ tons (Major) | ₹1,200 – ₹1,500/ton | Long-term contract | Townships, industrial projects |

| Direct from Plant | ₹1,200 – ₹1,400/ton | Self-arrangement | Cost-conscious large projects |

| Online Platforms | ₹1,500 – ₹1,900/ton | Platform-managed delivery | Transparent pricing, documentation |

Storage and Handling Best Practices

Proper sand storage prevents quality degradation and material loss, with well-organized storage potentially saving 5-8% through reduced wastage. Sand should be stored on elevated platforms or paved surfaces rather than directly on soil to prevent contamination with clay and organic matter. Segregate different sand types (river sand, M-sand, P-sand) clearly to prevent mixing, which can compromise concrete or plaster quality unpredictably. Moisture protection using tarpaulins or covered sheds maintains consistent moisture content, important because wet sand affects batching accuracy and can increase transportation weight by 10-15%.

Site storage planning should allocate approximately 150-200 sq ft space per 10 tons of sand with adequate access for loading equipment. Drainage around storage areas prevents waterlogging that increases silt and reduces sand quality over time. First-in-first-out (FIFO) inventory management ensures stored sand gets used before extended exposure causes quality changes. For premium projects, covering sand storage completely prevents wind-blown dust contamination and rain-induced silt washing, maintaining certified quality parameters throughout the construction period.

Future Outlook and Sustainable Alternatives

The construction sand market is experiencing fundamental transformation driven by sustainability concerns, technological innovation, and regulatory evolution. By 2029, the global sand market is projected to reach $2.48 billion for reclamation sand alone, growing at 7.3% CAGR, indicating massive expansion across all sand categories. India’s construction sector continues shifting toward manufactured alternatives, with government policies in multiple states mandating M-sand use in public infrastructure to preserve natural riverine ecosystems. This regulatory push, combined with M-sand’s proven performance in major infrastructure projects, suggests river sand will become increasingly specialized for only specific applications by 2028-2030.

Emerging alternatives include copper slag sand, recycled concrete aggregate fine particles, and manufactured sand from construction demolition waste, though these remain in early adoption stages. Technology developments like AI-powered quality control in M-sand production and blockchain-based supply chain transparency are improving manufactured sand consistency and market trust. Pricing trends suggest M-sand costs will remain stable or slightly decline due to increased production capacity, while river sand prices will continue rising 5-8% annually due to tightening regulations. Sustainability-focused construction certifications (IGBC, LEED) increasingly require documentation of sand sourcing, favoring manufactured alternatives with clear environmental compliance over traditionally-sourced river sand.